Investors are often cautioned against investing in stocks ahead of their earnings.

But there are a few of them that have massive room for growth and are trading at such attractive valuations that it may be reasonable to load up on them ahead of their quarterly financial results, according to Goldman Sachs analysts.

These include Uber Technologies Inc, Bill.com and IBM. Let’s take a closer look at why the investment firm is bullish on these three stocks.

Uber Technologies Inc (NYSE: UBER)

Uber shares run the risk of getting hurt as the autonomous vehicle technology continues to advance. But the valuation is currently too attractive to ignore, as per Goldman Sachs analyst Eric Sheridan.

In fact, the company’s stock price performance looks completely dislocated from its earnings power at writing, he added. Sheridan expects Uber to deliver a 30% yearly growth in EPS through 2026.

His “buy” rating on Uber stock is coupled with a $96 price target that indicates potential for another 40% upside from current levels.

All in all, the ride-hailing firm’s free cash flow, its profitability setup, and the margin upside offer sufficient reasons to load up on its shares ahead of the earnings release on February 5th, according to Eric Sheridan.

The California-based company is expected to release its fiscal Q4 earnings results on Wednesday, February 5.

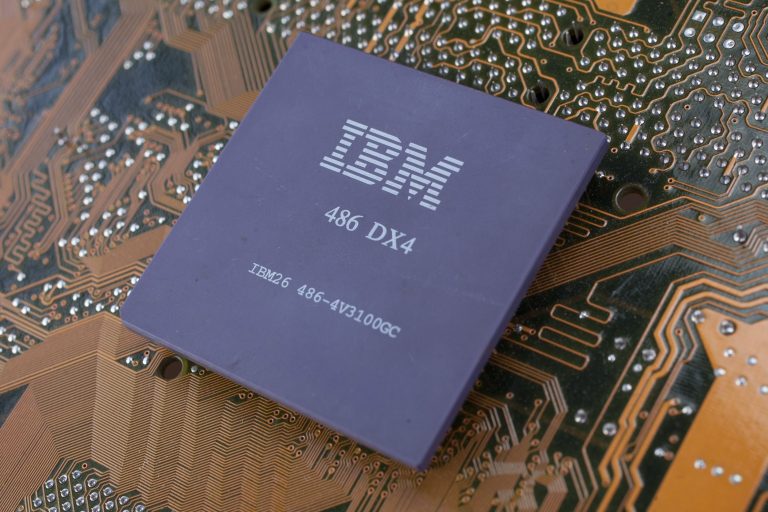

IBM (NYSE: IBM)

Goldman Sachs analyst James Schneider expects IBM’s earnings on January 29th followed by its investor day on February 4th to unlock significant upside in its share price.

Schneider is particularly positive on the company’s software business. “The stock could continue to move higher if the company is able to articulate a credible strategy for accelerating long-term software revenue growth,” he argued in a recent report.

Note that IBM is fully committed to building hybrid cloud solutions for large enterprises.

Additionally, IBM stock pays a rather healthy dividend yield of 2.97% at writing that makes up for another good reason to have it in your portfolio, according to James Schneider.

Bill Holdings Inc (NYSE: BILL)

Goldman Sachs remains bullish on Bill.com as it’s hitting full throttle ahead of earnings in the first week of February.

The investment firm’s analyst Will Nance recently upgraded the financial technology company to “buy” as it has a whole bunch of positive catalysts in 2025.

Concerns related to macro-overhangs are now subsiding, which could result in “strong revisions over the course of the year against the company’s conservative forecast,” he added.

Nance is convinced that lowering inflation and improving business confidence will materially benefit Bill.com. “The improving macro, in addition to BILL’s success in onboarding larger customers, positions the stock well for improving C2025 volume trends,” the analyst concluded.

Bill stock is currently down some 70% versus its high in the final quarter of 2021.

The post Uber, IBM, and Bill: why these 3 stocks are worth buying ahead of earnings appeared first on Invezz