Rolls-Royce share price has jumped to a record high, and is slowly nearing the important resistance level at 1,000p. RR stock has jumped by 74% this year, and by 120% in the last 120%, giving it a market capitalization to over $110 billion. So, will the RR stock continue soaring?

Rolls-Royce share price analysis

The weekly chart shows that the Rolls-Royce stock price has been in a strong bull run in the past few years. It has surged from a low of 36p in 2020 to a record high of 981p.

The stock has moved above the crucial resistance level at 809p, its highest swing on March 17. Moving above the key resistance level was notable as it invalidated the double-top pattern whose neckline is at 557p.

The Rolls-Royce share price has remained above the 50-week and 100-week moving averages. It has moved about 46% above the 50-week moving average, and 85% higher than the 100-week MA.

The Relative Strength Index (RSI) has jumped to the overbought point at 80, while the Stochastic Oscillator has soared to nearly 100. These indicators show that the stock still has high momentum.

Therefore, the most likely scenario is where the Rolls-Royce stock price rallies and hits the important resistance level at 1,000p. After doing this, the stock will likely retreat, albeit temporarily as investors book profits.

The retreat will also happen because the token has become highly overbought, while the Average Directional Index (ADX) has plunged to 29 from last year’s high of 67. A falling ADX is a sign that the momentum is falling.

In this case, the Rolls Royce share price could drop and retest the important support at 810p, the highest swing in March, and then resume the uptrend.

Rolls-Royce stock chart | Source: TradingView

Rolls Royce Holdings growth and valuation

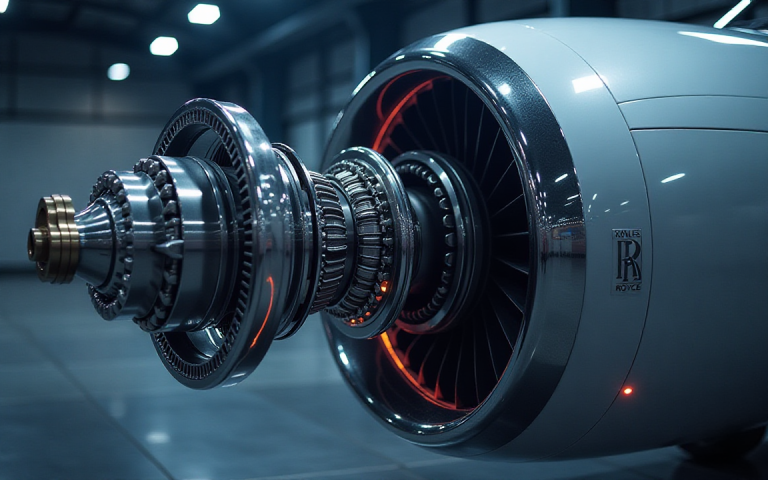

Rolls-Royce stock price has surged in the past few years as the company’s growth accelerated. Its three businesses: civil aviation, power, and defense, have done well.

The most recent results showed that the civil aviation segment’s revenue jumped by 24% last year to over £9.04 billion, while its free cash flow have soared by 224% to £2.03 billion.

This growth could accelerate in the coming months as aviation demand jumps. Airbus and Boeing have all received giant orders in the past few months, and Airbus is set to receive about 500 orders from China in July.

Business aviation, where Rolls-Royce has a substantial market share, is also expected to continue growing.

Rolls-Royce’s defence revenue jumped by 13% to £4.5 billion, helped by its submarine business. Again, this segment could gain more traction in the coming years as the US and Europ boosts defense spending.

The power systems segment grew by 11% last year, helped by its data center business. This segment will continue thriving as companies boost their AI infrastructure spending this year. Also, the company was selected to offer small modular nuclear reactors in the United Kingdom.

The main concern is that Rolls-Royce and General Electric Aviation are highly overvalued now. RR has a market cap of £80 billion and expects to make an operating profit of £2.9 billion this year. This gives it an earnings per share metric of 27, which is higher than many industrial companies.

The post Rolls-Royce share price nears 1,000p—but a pullback may be next appeared first on Invezz